Quick Navigation

Retro pay update

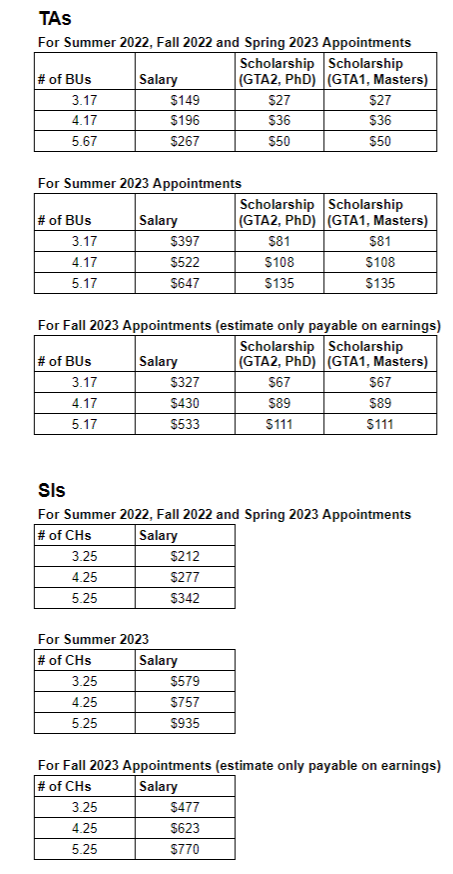

Retroactive pay for the wage increases due for May 1, 2022 and May 1, 2023 will be paid on the January 26, 2024 pay cheque. Some examples of typical retro pay owing are below. As with regular pay, retro pay will be net of statutory deductions and Union dues.

How you are paid: start and end dates

TSSU members are paid on a biweekly salary scale. Each 4-month semester corresponds to approximately 17 weeks, divided into 8.5 pay periods. Appointments during Intersession (May-June) and Summer (July-August) semesters have 4 pay periods. On your contract for the semester, the contract start and end dates indicate when you're an employee, while the payroll start and end dates indicate your schedule of pay. Because these dates don't often align, you may receive your last paycheque prior to the end of your work contract.

SFU's current payroll schedule can be found here.

Rates of pay by Job Type

The basic components of the salary scale for each category of employment are listed below. For more information contact us.

TAs & TMs

Wages are paid on a salaried basis and defined in terms of Base Units (BUs) which include 4% vacation pay. One BU corresponds to a maximum of 42 hours of work (less 1.1 hours for statutory holiday compensation). The dollar value per BU varies depending on your status as a student; all values are effective May 1, 2023:

| Student Status | Classification | Salary per BU | Scholarship per BU* | Total per BU* |

|---|---|---|---|---|

| Undergraduate | Undergrate TA/TM (UTA/UTM) | $1219 | $0 | $1219 |

| Master's | Graduate TA/TM 1 (GTA1/GTM1) | $1219 | $181 | $1400 |

| PhD | Graduate TA/TM 2 (GTA2/GTM2) | $1219 | $411 | $1630 |

| Non-Student | External TA/TM (ETA/ETM) | $1219 | $0 | $1219 |

*less unworked prep BUs (typically 0.17 BUs, but with some exceptions)

Using the table below you can calculate your correct rate of pay by multiplying the number of base units by the salary, and adding that amount to the amount obtained by multiplying the number of base units, less the 0.17 base units for unworked preparation, by the scholarship amount appropriate to your status. There are some exceptions to the base units subtracted for unworked preparation (eg: subsequent appointments in mathematics or statistics workshops).

For example, a GTA1 with a 5.17 BU appointment for Fall 2023 would receive 5.17 BUs x $1,219 salary + 5 BUs x $181 scholarship = $6,714 in total compensation.

TA/TM Historical Pay Amounts

| Date | Salary | GTA1/GTM1 Scholarship | GTA2/GTM2 Scholarship |

|---|---|---|---|

| May 1, 2023 | $1219 | $181 | $411 |

| May 1, 2022 | $1141 | $163 | $393 |

| May 1, 2021 | $1094 | $154 | $384 |

| May 1, 2020 | $1088 | $153 | $382 |

| May 1, 2019 | $1071 | $150 | $376 |

| April 30, 2019 | $1050 | $147 | $368 |

| May 1, 2018 | $1,031 | $144 | $361 |

| May 1, 2017 | $1,011 | $141 | $354 |

| May 1, 2016 | $992 | $138 | $347 |

| May 1, 2015 | $982 | $137 | $343 |

| May 1, 2014 | $972 | $135 | $340 |

| May 1, 2013 | $972 | $135 | $340 |

Sessional Instructors

Wages are paid on a salaried basis and defined in terms of contact hours which includes 4% vacation pay.

Using the table below you can calculate your correct rate of pay by multiplying the total number of contact hours (including the 1.25 contact hours for initial and ongoing preparation) by the salary rate listed below to determine your total compensation.

For example, a Sessional Instructor with 3 hours of weekly contact in Fall 2021 would receive (3.0 contact hours + 1.25 contact hours for prep) x $1,782 = $7,574 total compensation.

| Date | Salary per Contact Hour |

|---|---|

| May 1, 2023 | $1782 |

| May 1, 2022 | $1669 |

| May 1, 2021 | $1604 |

| May 1, 2020 | $1596 |

| May 1, 2019 | $1572 |

| April 30, 2019 | $1541 |

| May 1, 2018 | $1514 |

| May 1, 2017 | $1,485 |

| May 1, 2016 | $1,457 |

| May 1, 2015 | $1,443 |

| May 1, 2014 | $1,428 |

| May 1, 2013 | $1,428 |

Graduate Facilitators

Wages are paid on a salaried basis based on a initial contracted number of hours. Unlike for TA/TMs, the rates below do NOT include vacation pay, and either 4% or 6% will be paid on top, as owed pursuant to the Employment Standards Act.

| Date | Hourly Rate (+ vacation pay) |

|---|---|

| May, 1, 2021 | $27.84 / hr |

| Sept 1, 2020 | $27.29 / hr |

| June 10, 2019 | $25.50 / hr |

| Pre Unionization: | $24.04 / hr |

English Language and Culture (ELC) / Interpretation and Translation Program (ITP) / International Teaching Assistant (ITA) Instructors

Wages are paid on a salaried basis and defined in terms of contact rate, where 1 contact hour is a total of 2.33 hours of work, and thus 15 contact hours per week is a full 35 hour work week.

ELC INSTRUCTOR

PAY SCALE

Effective May 1, 2023

| Experience | Contact Rate | Actual Rate | |

|---|---|---|---|

| 1 | $78.15 | $33.49 | |

| 2 | $80.29 | $34.41 | |

| 3 | $82.45 | $35.34 | |

| 4 | $84.62 | $36.27 | |

| 5 | $86.76 | $37.18 | |

| 6 | $88.89 | $38.10 | |

| 7 | $91.06 | $39.03 | |

| 8 | $93.26 | $39.97 | |

| 9 | $95.38 | $40.88 | |

| 10 | $97.50 | $41.79 | |

| 11 | $99.68 | $42.72 | |

| 12 | $101.81 | $43.63 | |

| 13 | $103.97 | $44.56 | |

| 14 | $106.18 | $45.51 |

ITP &ITA INSTRUCTOR

PAY SCALE

Effective May 1, 2023

| Service Years | May 1, 2023 | |

|---|---|---|

| 1 | $73.83 | |

| 2 | $75.54 | |

| 3 | $78.95 | |

| 4 | $82.34 | |

| 5 | $85.75 | |

| 6 | $89.16 | |

| 7 | $92.55 | |

| 8 | $95.96 | |

| 9 | $99.50 |

Guide on how to check your pay stubs

- Log in to myINFO;

- Click "Payroll and Compensation Home";

- Click "View Paycheques";

- You will see a list of pay stubs -- select view paycheque to open a pdf copy that can be printed or saved.

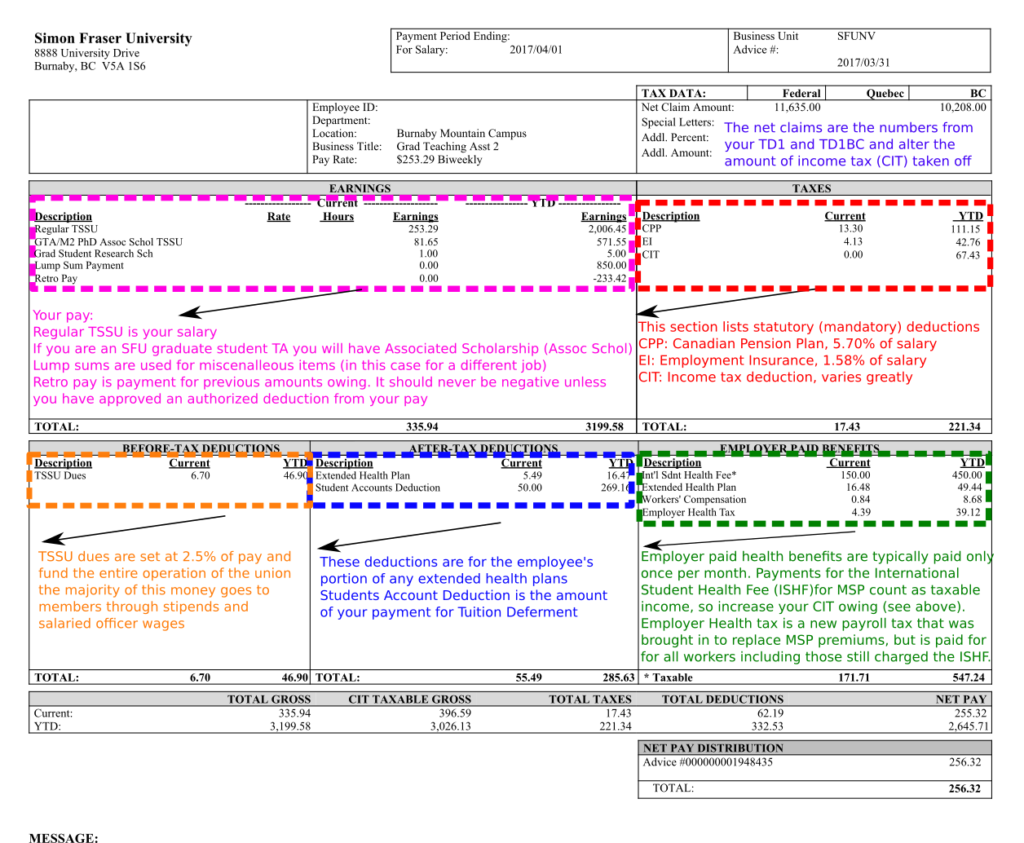

Here's an image with a guide to your pay stub.

- Download our TSSU Wage Tracker Here (Excel File)

- Follow the directions found on each excel sheet & the intro sheet.

- Add up all of your biweekly gross amounts in our convenient downloadable excel spreadsheet by each semester you were employed (you can switch between semesters at the bottom by clicking on the different excel 'sheet').

If you think that you have lost pay for any reason, please contact us.

To read more about your pay in the Collective Agreement please see Article 29 of the Collective Agreement

Wage Problems at SFU

In the past, TSSU members noticed significant fluctuations in their biweekly salary and investigated why this was happening. In the process, they uncovered the following issues:

- SFU had not been paying their full and proper wage for the semester according to their pay grade;

- SFU had overpaid them and then illegally subtracted subsequent pay without negotiating a proper repayment plan;

- SFU had not been paying them on time.

Below is a guide on how to determine if any of the above has happened to you. Depending on how many semesters you've taught at SFU, the wage tracker could take some time to complete. Download our TSSU Wage Tracker Here (Excel File)

TSSU has identified at least four types of illegal wage theft at SFU:

1. How to spot if SFU is under-paying

- Underpaying: not paying the full and proper amount on your contract; being asked to work beyond the maximum hours allotted in your Time Use Guideline TUG) without receiving additional pay.

- If your gross earnings in a semester do not equal your total contract value, you are being underpaid - this is illegal!

If you notice that you are being underpaid, contact us.

2. How to spot if SFU is withholding pay

- Withholding pay: not being paid on time.

- It is illegal for SFU to withhold pay because you have not signed a contract "on time". In British Columbia, all wages earned in a pay period must be paid within eight days of the end of the pay period. If you can provide documentation that you have accepted a position or performed work before the SFU pay period end date, then you must be paid within eight days.

If SFU has withheld your pay, contact us.

3. How to spot if SFU is illegally deducting pay

- Legal deductions include: Canadian Income Tax (CIT); Canada Pension Plan (CPP); Employment Insurance (EI); Union Dues.

- SFU can make deductions required by law only; SFU cannot make other deductions without telling you and without your consent - this is illegal!

SFU must seek your agreement, in writing, for any other deductions. Deductions for over-payment, tuition deferment, accidental scholarship disbursement, or for any other reason are illegal without your written consent to a mutually agreeable repayment schedule.

If you have negative numbers on your pay stub and do not know why, contact us.

4. How to spot if SFU is charging you for business expenses

- As employees, TSSU members are not required to pay for any portion of materials related to the teaching position. Materials include photocopying, textbooks, A/V costs, lab coats, safety goggles, or other required equipment/tools.

- SFU cannot make you pay for costs related to your employment - this is illegal!

If you have paid any costs for your TSSU appointment, contact us.