Recently TSSUs members noticed their pay cheques were fluctuating every pay period and investigated why. In the process some discovered that SFU had not paid them their full wage this semester according to their pay grade, some discovered that SFU had subtracted pay without negotiating a repayment plan for overpayment, and others had not been paid on time.

(To learn more about these wage issues, also known as wage theft, click here).

Below is a guide on how to access & read your paystubs, and finally how to determine if any of the above has happened to you. Depending on how many semesters you've taught here, this tracking could take an hour or so. Download our TSSU Wage Tracker Here (Excel File)

Guide on how to check your pay stubs.

- Find your paystubs. Log on at myINFO.sfu.ca.

- Click "Payroll and Compensation Home"

- Click "View Paycheques".

- You are now viewing your most recent paystub.

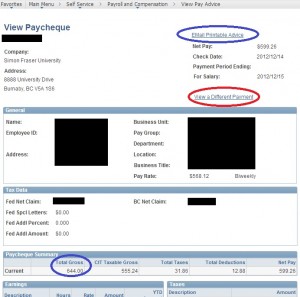

- To view other paystubs click on the blue hyperlinked line near the top middle "View a different payment" (Circled in red in the image above).

- To view your gross pay (that shows how much you are paid BEFORE taxes are taken out) scroll down on each e-stub to the line that says "Gross Pay". You can also click on the blue hyperlinked line near the top right "EMail Printable Advice". An attachment will be emailed to your SFU account that you can save and view. (Both are circled in blue in the image above).

- Download our TSSU Wage Tracker Here (Excel File)

- Follow the directions found on each excel sheet & the intro sheet.

- Add up all of your biweekly gross amounts in our convenient downloadable excel spreadsheet by each semester you were employed (you can switch between semesters at the bottom by clicking on the different excel 'sheet').

If you think that you have been shorted due to any sort of error please email tssu(at)tssu.ca with the subject "Wage Issues".

To read more about your pay in the Collective Agreement please see p59 (TA),

p60 (SI), p64 (TM).

--------------------------------------------------------------------------------------------------------------------

Help us translate this document to your preferred language! Contact tssu@tssu.ca for more information. Compensation is available.

Hello TSSU Member,

We have identified four different wage issues at SFU. These issues are illegal and are also known as wage theft. This guide explains all four and provides an excel template to help you determine if any of these issues have happened to you.

1. What is Underpaying?

2. What is Withholding Pay?

3. What is Deducting Pay?

4. What is Charging Business Expenses?

--------------------------------------------------------------------------------------------------------------------

*For ELC & ITP members please email dereks@tssu.ca

--------------------------------------------------------------------------------------------------------------------

1. How to spot if SFU is Underpaying:

- Underpaying is not paying the full amount on your contract. If your gross earnings in a semester do not equal your total contract value and benefits you are being underpaid. This is illegal.

- Underpaying is also asking you to work over the allotted hours in your Time Use Guidelines (TUG) without extra pay.

Contact tssu(at)tssu.ca if you have gone over your hours or if you are being underpaid.

2. How to spot if SFU is Withholding Pay (not being paid on time):

- If SFU is withholding your pay because you do not sign a contract "on time" it is illegal.

- If you can provide documentation that you have accepted a position or performed work before the SFU pay period end date you must be paid within 8 days. In British Columbia, all wages earned in a pay period must be paid within eight days after the end of the pay period.

Contact tssu(at)tssu.ca if you have not been paid within 8 days of the payroll dates.

3. How to spot if SFU is Deducting Pay:

- SFU cannot make deductions from your cheque without telling you. This is illegal. SFU can only make deductions that are required by law.

- Legal deductions are; Income Tax, Canadian Pension Plan, Employment Insurance, and Union Dues.

SFU must seek your agreement in writing for any other deductions. Deductions for overpayment, tuition, accidental scholarship disbursement or any other reason are illegal without your written consent to a mutually agreeable repayment schedule.

Contact tssu(at)tssu.ca if you have any negative numbers on your paystub and don't know why.

4. How to spot if SFU is Charging you Business Expenses:

- SFU cannot make you pay for any costs for your TA-ship. This is Illegal. Employees are not required to pay for any portion of materials related to your teaching position; this includes photocopying, textbooks, AV costs, lab coats, safety goggles or anything else you need to do your job.

Contact tssu(at)tssu.ca if you have paid any costs of your TA/TM/Sessional or ELC/ITP appointment.

--------------------------------------------------------------------------------------------------------------------

Help us translate this document to your preferred language! Contact tssu@tssu.ca for more information. Compensation is available.